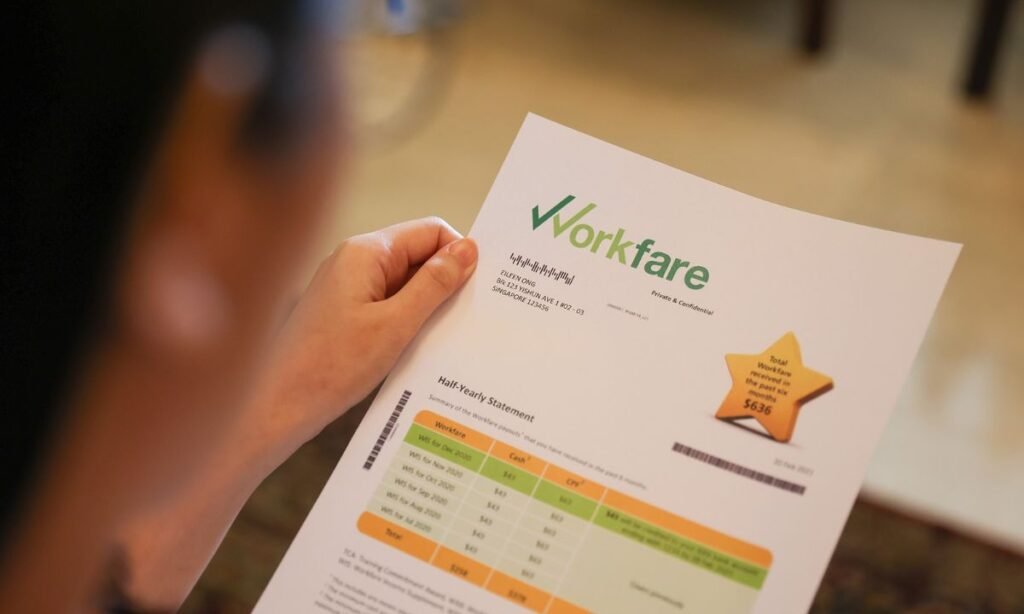

In 2025, the Singapore government continues its commitment to supporting lower-income workers through the enhanced Workfare Income Supplement (WIS) scheme. This initiative, designed to encourage employment and supplement earnings, provides eligible Singaporeans with payouts of up to $3,267 annually. The scheme recognizes the contributions of lower-wage workers to the nation’s economy and seeks to reduce income inequality while promoting work and individual effort.

Eligibility Criteria for WIS in 2025

To qualify for the 2025 WIS payment, applicants must be Singapore citizens aged 30 and above (or persons with disabilities aged 13 and above), earning a monthly income of not more than $2,500. Additionally, they must be employed or self-employed and must have declared their income to the Inland Revenue Authority of Singapore (IRAS). The program specifically targets those in lower-wage employment brackets and is structured to provide greater benefits to those with lower incomes and higher age.

Breakdown of the Maximum Annual Payout

Under the current structure, qualifying workers can receive a maximum of $3,267 annually. This amount varies depending on income level, age, and employment type. Payments are disbursed monthly and can be credited directly to the recipient’s CPF accounts and personal bank accounts. For self-employed individuals, part of the payout goes toward CPF Medisave to help build healthcare savings. This approach ensures not only immediate financial relief but also long-term support.

Monthly Disbursement Dates and Payment Channels

WIS payments are disbursed on a monthly basis for employed individuals, usually within the first few weeks of each month. For self-employed individuals, the payments are typically made annually, following the completion and verification of income declarations. Payments are made via direct bank transfer or through government-linked accounts like CPF, ensuring a secure and convenient process. It’s essential for beneficiaries to ensure their banking details are updated with the relevant authorities to avoid payment delays.

How WIS Encourages Employment and Retirement Adequacy

The WIS scheme is part of Singapore’s broader strategy to promote work as a pathway to self-reliance and to strengthen retirement adequacy through CPF contributions. By providing both cash and CPF top-ups, the government ensures that lower-wage workers not only benefit in the short term but also accumulate savings for healthcare and retirement. This dual-purpose approach has proven effective in supporting workers’ present and future financial stability.

WIS and Social Mobility in Singapore

Beyond financial aid, the WIS scheme symbolizes Singapore’s ongoing effort to improve social mobility. It rewards consistent employment and incentivizes workers to remain in or return to the workforce. This not only enhances individual dignity but also supports economic participation and social inclusion. As the scheme evolves, the government continues to fine-tune it to ensure that more workers benefit meaningfully and sustainably.

What Beneficiaries Should Do Next

Eligible individuals are encouraged to ensure their income details are accurately declared to IRAS and that they have linked their bank accounts for direct disbursement. They should also stay informed through official government channels about any upcoming changes or review dates. With its well-structured monthly payouts and supportive criteria, the WIS scheme remains a cornerstone of Singapore’s social support framework in 2025.